Key Points

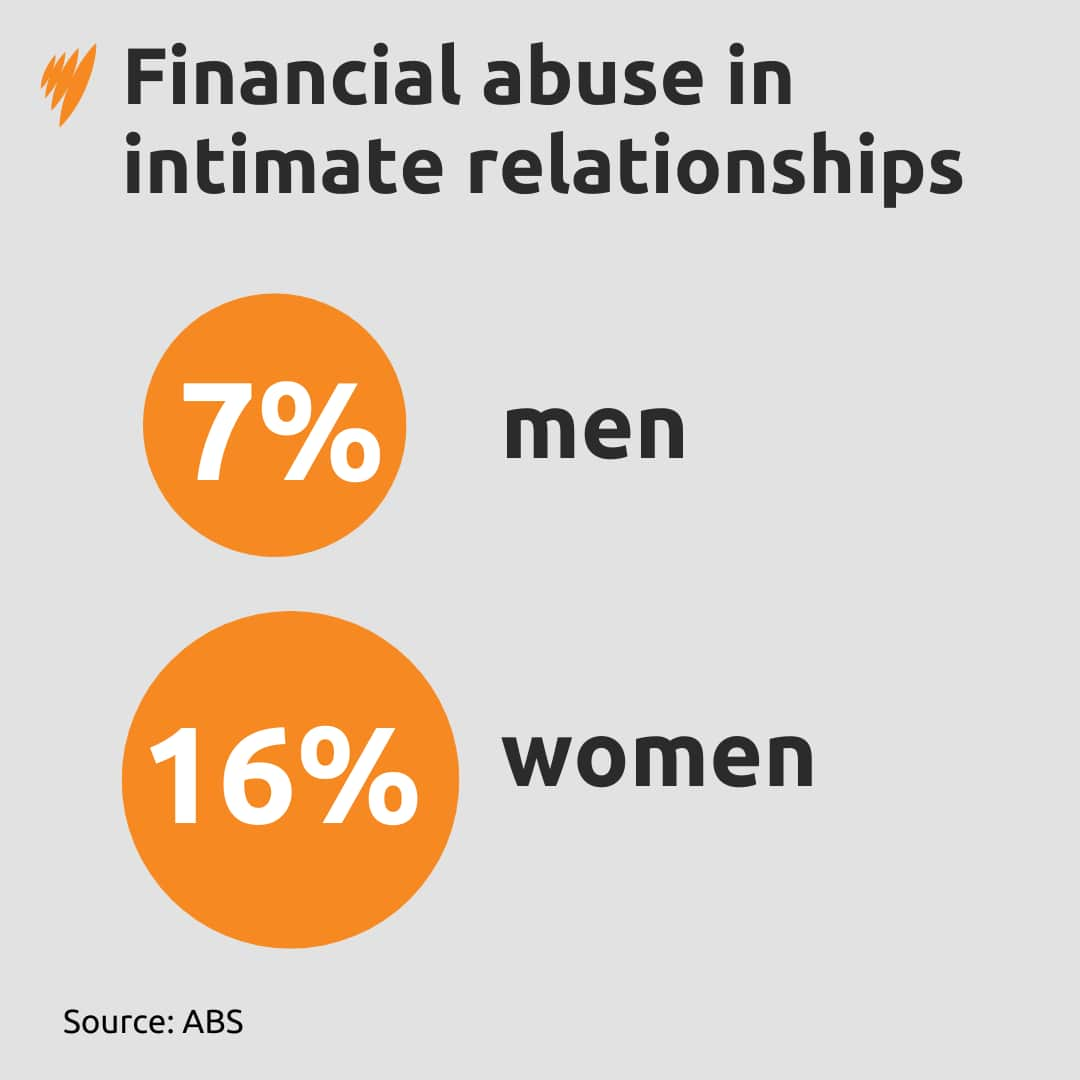

- According to the Australian Bureau of Statistics, 16 per cent of women and seven per cent of men have experienced financial abuse from their intimate partners.

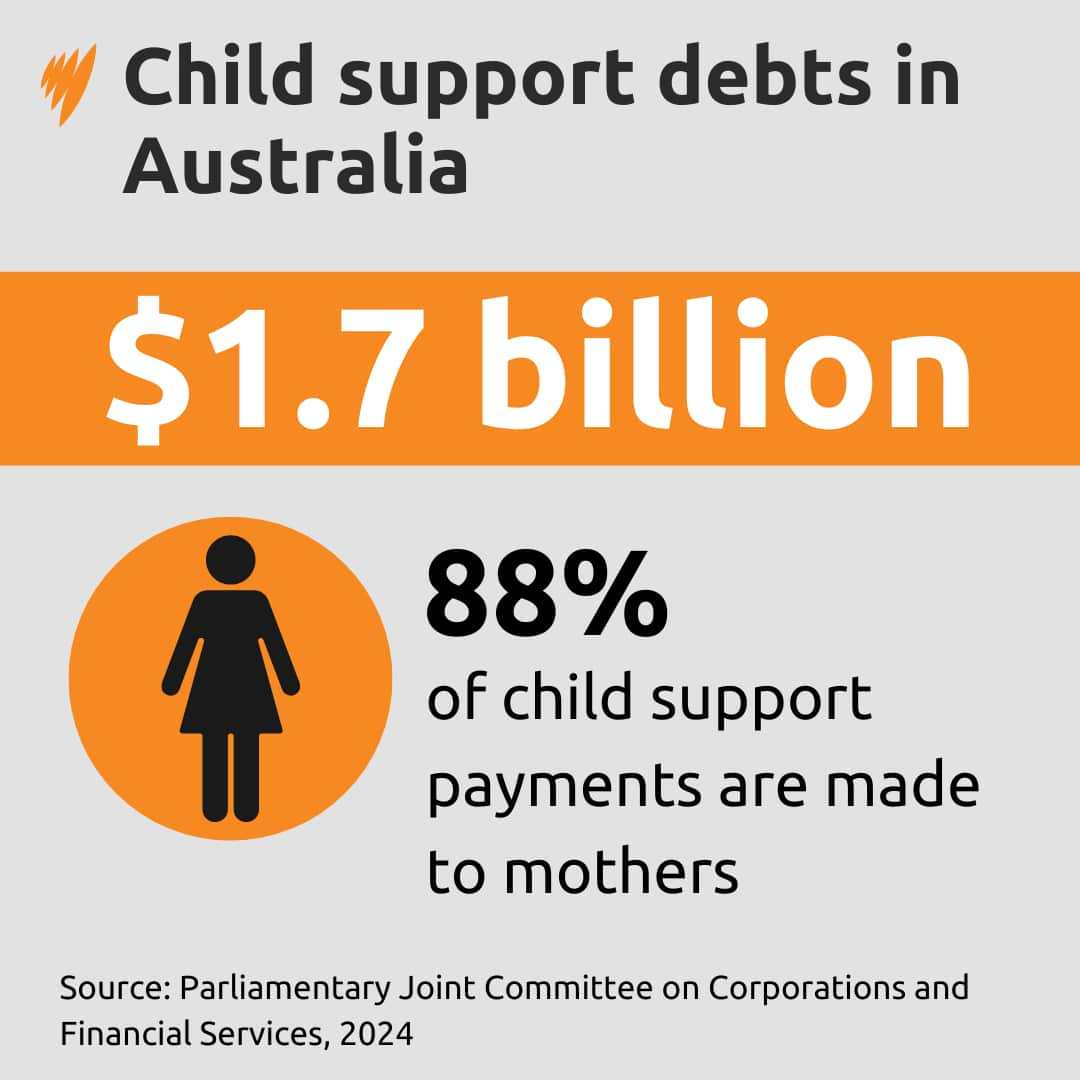

- The Senate Law Committee and Services Australia report the total child support debt is $1.7 billion.

- A recent parliamentary report has recommended enabling the Australian Taxation Office to assume responsibility for government child support collections.

Svetlana* (not her real name) left her abusive husband and agreed to shared custody of their two children.

After a lengthy court process to determine a financial settlement, she was able to keep ownership of one of the couple’s properties where she moved in with her children.

“There is a huge loan on it, that I am paying back every month,” she told SBS Russian.

“I have a good job, but no matter how much I work, all the money goes towards the mortgage and basic daily expenses.”

She decided to file for support from the government.

“I submitted the documents to Centrelink and Child Support hoping to receive some help. But in response (I) was told that my ex-husband didn’t file his taxes the previous year, therefore his salary was considered to be zero,” she said.

“The agency said since we have ‘shared care’ over our children, by law I have to pay child support to him.”

Svetlana sent objection forms and bank account statements, showing her ex-husband’s business income and money transfers from that business.

“I even provided court documents where he was stating that he works and receives a salary. But they [the agency] haven’t responded to this yet,” she said.

Professor Kay Cook, associate dean of research in the School of Social Sciences, Media, Film and Education at Swinburne University of Technology, said Svetlana’s story while extreme, was not a surprising example of how the Australian child support system worked.

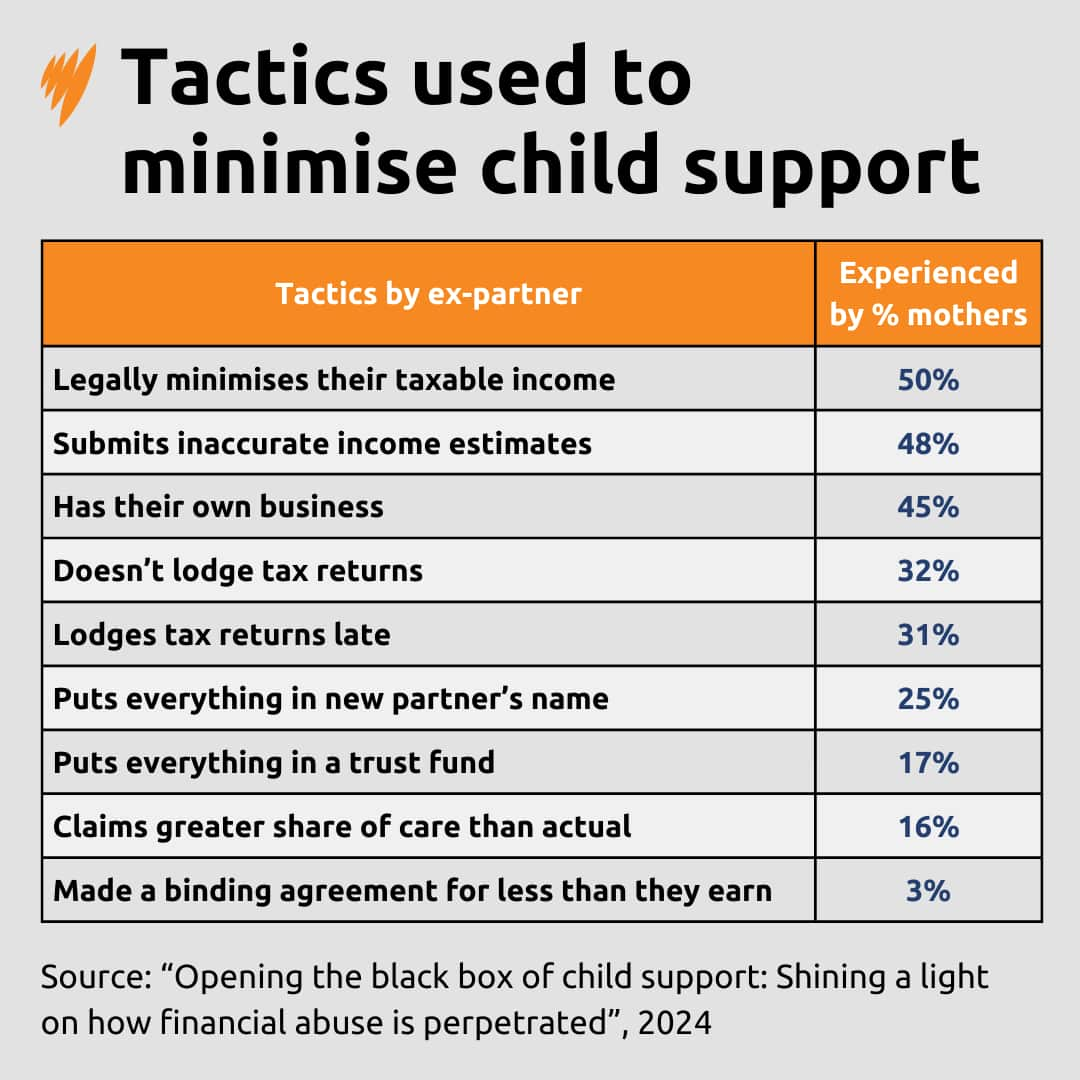

In October this year, Cook, with colleagues, published a report entitled “Opening the black box of child support: Shining a light on how financial abuse is perpetrated”.

Based on the experiences of 675 single mothers in Australia, the report found that 20 per cent of them ended up having to pay child support to their ex-partners, because their partners’ taxable incomes were inaccurate or artificially low.

A recent parliamentary inquiry heard financial abuse takes many forms in Australia and is mostly targeted at women and children and perpetrated by men. Credit: SBS

‘Primarily experienced by women’

According to the Australian Bureau of Statistics, 16 per cent of Australian women and seven per cent of men have experienced financial abuse from their intimate partners.

The federal inquiry into financial services regulatory framework in relation to financial abuse heard that financial abuse took many forms in Australia ranging from restriction to employment or access to finances to withholding or non-payment of child support.

Labor senator Deborah O’Neill, chair of the joint committee on corporations and financial services, that conducted the inquiry, said: “Financial abuse is primarily experienced by women and children and is primarily perpetrated by men.”

Drawing on submissions from victim-survivors, front-line service providers and other agencies, the committee called financial abuse “a national issue that cannot be ignored”.

The inquiry report tabled in early December 2024 contains 61 recommendations — from superannuation to banking sector reforms.

Five of the recommendations target Australia’s child support system and the ways it has been “weaponised by perpetrators trapping women and children in financial abuse”.

A recent parliamentary report recommends enabling the Australian Taxation Office to assume responsibility for government child support collections.

‘Women expected to be private detectives’

The inquiry heard that there was an estimated $1.7 billion debt in child support, with 88 per cent of payments made to mothers.

Additionally, the Swinburne University report showed that four out of five single mothers had experienced delayed or non-payment of child support by their ex-partners and deliberate reduction of child support responsibilities.

Christina* (not her real name) told SBS Russian that her “abusive” ex-partner had used several tactics to reduce or delay payments over the years such as delaying confirming change of workplace and higher income, or failing to file his tax returns on time.

She said she was confused by the Australian system and why government agencies had no powers to enforce child support payments.

Prof Cook explained that their research showed that an overwhelming percentage of mothers wanted the Australian Taxation Office to be responsible for child support.

“Women want the government to collect it. But all of the government’s powers are ‘well, we can send them a letter and we can ask’. The only tool that the government has is a departure prohibition order (DPO),” she said.

A DPO prevents a person who has a child support debt or carer debt from leaving Australia.

“Women are expected to be private detectives and do all of the work for the government, while also likely living in poverty.”

According to Swinburne University research, four out of five single mothers in Australia have experienced delayed or non-payment of child support by their ex-partners and deliberate reduction of child support responsibilities. Credit: SBS

‘Enormous discrepancy’

Prof Cook added that the official amount of $1.7 billion in child support debt didn’t account for 49 per cent of cases that were registered for the private stream.

In Australia, child support payments are collected either privately or through a dedicated agency, part of Centrelink.

“You might just get a bank transfer from your ex-partner, or they might give you cash when the children are visiting (them),” Prof Cook told SBS Russian.

She said there was “an enormous discrepancy” between the experiences of women and the official accounts.

“The government assumes that all of those payments are 100 per cent compliant in full at the time they were owed, which is definitely not the case.”

The inquiry found that nearly half of women in the private stream were pressured by their ex-partners to avoid payments, and 70 per cent of these women did not receive payments in full or at all.

In response to the findings, the inquiry recommended enabling the Australian Taxation Office to be responsible for child support collections.

It recommended mandating annual declarations both from payer and payee to the Australian Tax Office. When these declarations are not made or payments are not aligned, the case would be converted from private to the agency stream.

Additionally, it recommended raising tax debts against payers with child support debts.

In a statement to the report, O’Neill said that these recommendations “represent a moment of hope and potential change for our nation”.

SBS Russian sought comment from the Minister for Social Services, as to whether the federal government would act on any of the recommendations. A ministerial spokesperson did not respond to the request by time of publication.

If you or someone you know is impacted by family and domestic violence, call 1800RESPECT on 1800 737 732 or visit . In an emergency, call 000.