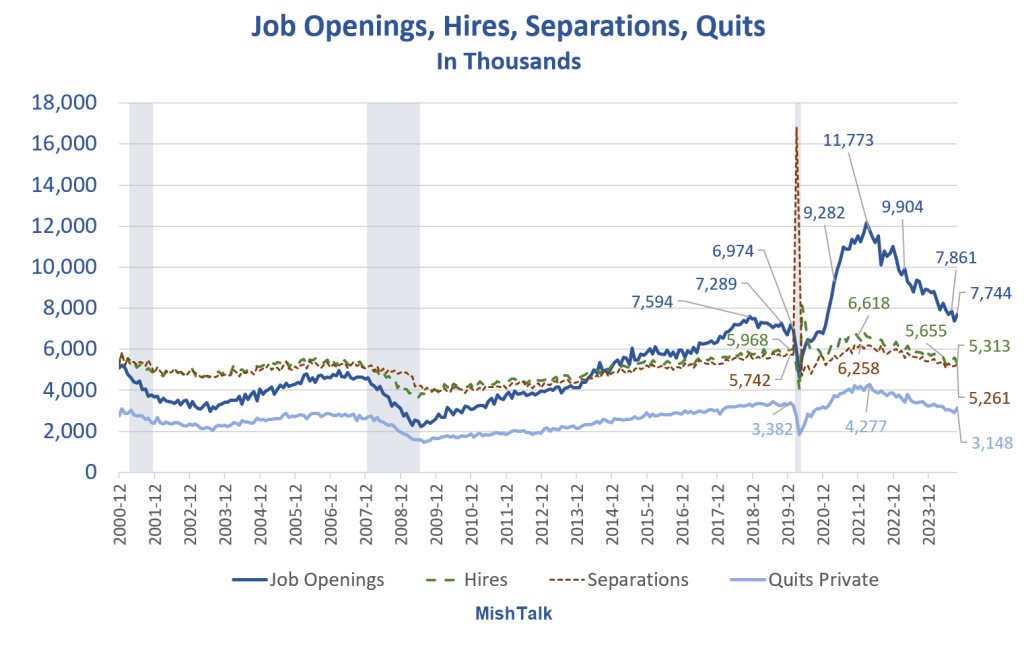

The number of job openings continues to shrink and revisions tend to be negative.

The BLS released the Jobs Openings and Labor Turnover Survey (JOLTS) for October on Wednesday. I am catching up today.

- At the March 2022 peak, there were 12,182,000 job openings vs an unemployment level of 5,993,000. There were nearly two openings per those unemployed.

- There are now 7,744,000 opening vs an unemployment level of 6,984,000. The unemployment level will soon top openings.

- Quits are voluntary separations. The number of quits is well below the pre-Covid level.

The number of openings is suspect. Many positions are fake or stale. Others exist only if the exact right person comes along.

In contrast, quits are relatively hard data (subject to BLS measurement), representing actions, not words. Quits are a measure of ability to find another job at better pay or benefits plus retirements.

Job Openings, Hires, Separations, Quits

Job Quits by Sector in Thousands

Job quits in Leisure and Hospitality, the overlapping Accommodation and Food Service sector, and Retail Trade have collapsed.

If you quit a job or are laid off, it’s not that easy to find another job.

Job Openings Per Unemployed Person

Openings per unemployed person is below the pre-pandemic level. And openings are likely overstated.

The 2024 Destruction of Small Business Employment in Pictures

In case you missed it, please see The 2024 Destruction of Small Business Employment in Pictures

Trends are especially ominous in businesses of 20-49 employees, down by 118,000 year-over-year.

Small businesses with employees 1-49 are struggling in 2024. Large businesses are booming (for now).

Reflections on BEA Revisions

If jobs are overstated, income is too. And on Wednesday we found out the BEA overstated wages by a massive $91.8 billion from $156.8 billion to $65.0 billion.

Please note the Huge Negative Revision of $91.8 billion to Second-Quarter Private Wages

The BEA commented “With the incorporation of these new QCEW data, real gross domestic income is now estimated to have increased 2.0 percent in the second quarter, a downward revision of 1.4 percentage points from the previously published 3.4 percent estimate.”

I commented “The BEA hugely revised GDI to the downside. Hmm. It seems that voters weren’t fooled.”

Click on the above link for more details and charts.