Continued claims look bad. But they are only part of the picture. The complete picture suggests recession.

This morning the Department of Labor released Weekly Unemployment Claims numbers.

Initial Claims

- In the week ending October 19, the advance figure for seasonally adjusted initial claims was 227,000, a decrease of 15,000 from the previous week’s revised level.

- The previous week’s level was revised up by 1,000 from 241,000 to 242,000.

- The 4-week moving average was 238,500, an increase of 2,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,250 to 236,500.

Neither Hurricane Milton nor Hurricane Helene had a lasting impact on new claims.

The Bloomberg Econoday consensus was an increase to 247,000 from 241,000. Instead initial claims fell by 15,000.

The good news ends there.

Continued Claims

- The advance number for seasonally adjusted insured unemployment during the week ending October 12 was 1,897,000, an increase of 28,000 from the previous week’s revised level.

- This is the highest level for insured unemployment since November 13, 2021 when it was 1,974,000.

- The previous week’s level was revised up 2,000 from 1,867,000 to 1,869,000. The 4-week moving average was 1,860,750, an increase of 17,500 from the previous week’s revised average. The previous week’s average was revised up by 500 from 1,842,750 to 1,843,250.

Insured Unemployment

The key phrase above is “insured unemployment”.

After someone expires all of their unemployment benefits they become “uninsured unemployment” and the Department of Labor stops tracking.

Expiring Unemployment Benefits

- Most states offer 26 weeks of unemployment benefits.

- Many states with a maximum of 26 weeks use a sliding scale based on a worker’s earnings history to determine the maximum number of weeks they qualify

- Arkansas, Iowa, Oklahoma, South Carolina, Missouri, North Carolina, and Kentucky have a lower number of week.

- Massachusetts allows up to 30 weeks depending on conditions. Montana allows 28 weeks of benefits.

Benefits Expired

Other than Montana and Massachusetts, continuing unemployment claims die at a maximum of 26 week.

Continuing claims understate long-term unemployment by the number of people unemployed for over 26 weeks (and then some factoring in seven states with lower benefits and states with sliding scales of benefits).

Ominous Trends

I discussed the above on September 19 in The Ominous Reason Continued Unemployment Claims Have Improved

The improvement (see the September dip in the lead chart) portrayed a rosy view that did not exist.

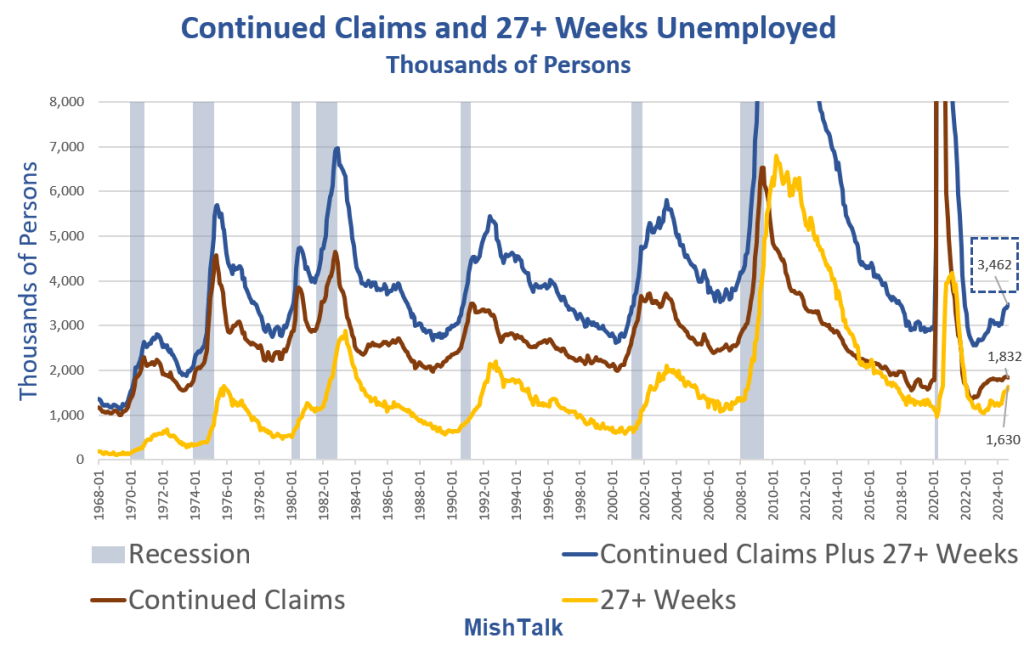

Continued Claims and 27+ Weeks Unemployment

Neither Hurricane Milton nor Helene has anything to do with 26 weeks of unemployment, but the hurricanes do have a small impact on recent continued claims (red line).

The above chart looks ominous because it is ominous. And those numbers are September averages. October will be much worse.

Please don’t tell me the numbers are low. They aren’t. But more importantly, it’s major upturns from lows that matter, not the raw numbers.

Continued Plus Long-Term Unemployment Claims Suggest Recession Right Now

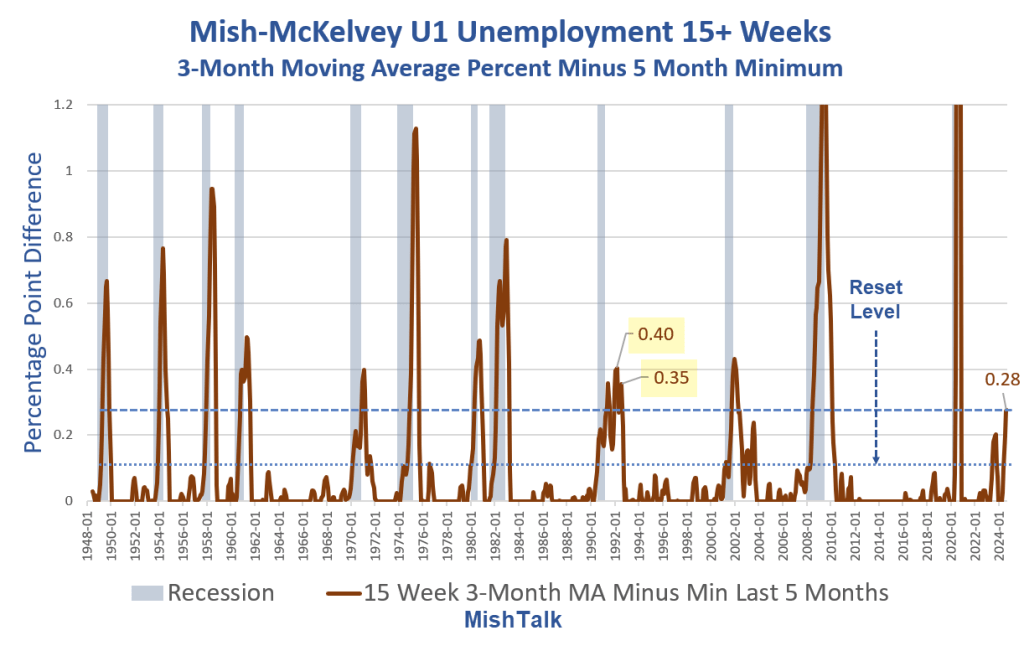

On the basis of continued claims instead of unemployment rate, I created a new recession indicator.

The Mish-McKlevey recession signal has no false negatives since 1948. It has either zero of two false positives depending on the level needed to reset the indicator.

For discussion, please see Continued Plus Long-Term Unemployment Claims Suggest Recession Right Now

The current value of 0.28 is very elevated and strongly suggests the US is in recession right now.