The Philadelphia Fed All Tenant Regressed Rent index suggests rapid deceleration in rent increases, perhaps even declining.

Chart Notes

- ATRR is an index created by Philadelphia Fed economists in cooperation with the BLS. It includes both new and existing leases unlike flawed models based on new leases only.

- Rent is the BLS measure of non-owner occupied rent, the typical apartment lease. It’s called rent of primary residence.

- OER stands for Owners’ Equivalent Rent. It is the BLS measure of the rent someone would pay to rent their own house, unfurnished, without utilities.

Contrary to popular myth, the BLS does not use homeowners’ estimate to determine price. The BLS does use homeowner estimates to set weights, but not the index.

Rent and OER are very lagging measures due to BLS smoothing. This is because people pay rent monthly not a year in advance.

ATRR leads rent and OER by a quarter.

Disentangling Rent Methods

The BLS does a good job explaining the lead-lag issues of various methods in a white paper Disentangling Rent Index Differences: Data, Methods, and Scope

Prominent rent growth indices often give strikingly different measurements of rent inflation. We create new indices from Bureau of Labor Statistics (BLS) rent microdata using a repeat rent index methodology and show that this discrepancy is almost entirely explained by differences in rent growth for new tenants relative to the average rent growth for all tenants. Rent inflation for new tenants leads the official BLS rent inflation by 4 quarters.

Why are these alternative rent measures reading so much hotter? Is the divergence because these measures focus on different segments of the rental market? The CPI rent sample is fully representative of the rental housing stock in US cities. In contrast, the Corelogic Single Family Rent Index (SFRI) covers mainly higher-tier detached rental units that advertise in the Multiple Listing Service (MLS), and the MRI covers larger apartment complexes in a restricted number of cities (Ambrose et al. 2018).

The paper was written in October of 2022 when Zillow and other new lease measures were jumping wildly. The reverse is happening now.

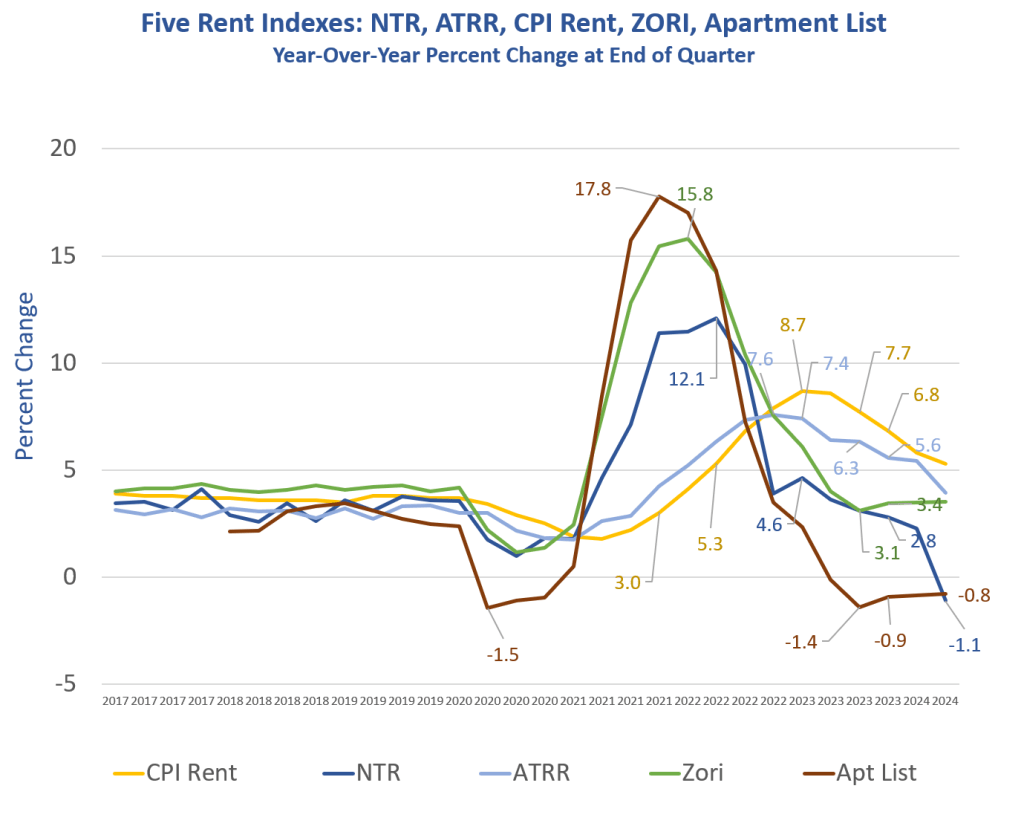

Five Rent Indexes Year-Over Year 2024 Q2

Zori stands for Zillow Observed Rent Index. Apt List is Apartment List. NTR is the Philadelphia Fed component measure of new tenants only as opposed to the lead chart of all tenants.

Zillow and Apartment List have a lead time of over a year, but are wildly on the high side.

Inflatiionistas were mistakenly howling about 17.8 percent rent increases in 2021. And then Deflationistas started screaming two years ago the Fed should be cutting.

Ironically, those other measures are so flawed, the BLS measures appear to be much better, just more lagging. What a hoot.

The problem with alternative measures like Zillow and Apartment List is they represent new leases only although only 10 percent of the population moves in a year.

This creates huge jumps and subsequent declines not at all reflective of the overall market because increases and decrease change more than leases for existing tenants.

The upward year-over-year slope on Zillow and Apartment List is amusing. Also note that Apartment List says year-over year prices are -0.8 percent, while Zori of +3.4 percent and NTR is -1.1 percent.

Are any of them right?

NTR Confidence Range 2024 Q2

Further adding to the unreliability of new lease measures, note the confidence range of the Philadelphia Fed NTR data is -3.53 percent to +1.32 percent.

I suggest throwing all of this new lease info in the ashcan where it belongs or at least weighting the data at no more than 10 percent.

With that, let’s return to ATRR, a genuinely leading (although volatile) indicator of CPI measures.

All Tenant Regressed Rent Index vs CPI Quarter-Over-Quarter

That is the chart that made me stand up and say whoa Nellie.

The quarter-over-quarter ATRR measures are more volatile than I like, but they are quickly mean-reverting. I suspect volatility is due to the NTR component where confidence ranges improve over time.

Once again, note the lead time of ATRR over rent and OER of about one quarter. This is very useful.

All Tenant Regressed Rent Index vs CPI Rent Index 2024-Q2

NTR peaked three quarters ago. ATRR peaked one quarter ago. Together they suggest flat to slightly declining measures of rent and OER starting soon.

I am not sure why ATRR tracks OER more closely than rent but that’s a good thing from the point of predicting where the CPI is headed given the huge weight of OER in the CPI.

OER is the largest component of the CPI with a weight of 26.8 percent. Tack on another 7.6 percent for rent of primary residence and you are at one-third of the CPI.

Rapid Cooling of Rent Inflation

Based on the above data, I expect a rapid cooling of CPI year-over-year measures of both rent and OER.

I think we start to see this in the next CPI report on September 11. If not, then October. This is one of the reasons I have been expecting the Fed to cut 50 basis points this month.

I will put some numbers on a CPI estimate on Monday. I expect to be on the low end of economic forecasts, perhaps the lowest.

As always, I can be easily wrong. The most likely way is to be early once again because this data is very compelling.

Things Consistent With Recession

I would not be short bonds heading into the next CPI report.