A Tweet today on on the three most important uses of Bitcoin caught my eye. Let’s discuss the three uses.

Bitcoin as Collateral

“Bitcoin is the ultimate collateral because it is priced 24/7 and can be transferred 24/7. Something skeptics miss.”

A Word About Volatility

Using something volatile as collateral will eventually lead to margin calls and forced selling.

It’s a disaster waiting to happen, assuming Bitcoin really is used as collateral.

Bitcoin Accepted Here

As for transactions, nearly 100 percent of Bitcoin transactions are buying and selling Bitcoin, in other words, speculation.

Most of the rest of the Bitcoin transactions are really fiat-transactions in disguise.

Q: What does “Bitcoin Accepted Here” mean in practice?

A: In the vast majority of cases, the merchant who takes Bitcoin immediately converts it to dollars, euros, or the local currency.

Buying something with Bitcoin is thus a preference for dollars (good prices in dollars, euros, etc.) rather than Bitcoin. These transactions are net negative to the price of Bitcoin.

Ironically, it’s a good thing for the price of Bitcoin that people like to hold it for speculative appreciation.

What is HODLing?

HODLing is speculation that Bitcoin is the ultimate asset that will always rise over time in the long run despite record up-down volatility as an asset.

The near universal, ~100 percent use of Bitcoin is speculation. But volatility is a benefit for true believers who can gleefully buy the dip.

That volatility makes it a terrible for collateral use and very questionable for transaction use (other than cashing out after a big run, hoping for a decline).

I suspect many Bitcoin fans will accept most of what I just said if they are at all honest and understand what using Bitcoin to buy something really means.

My next sentence will be more controversial.

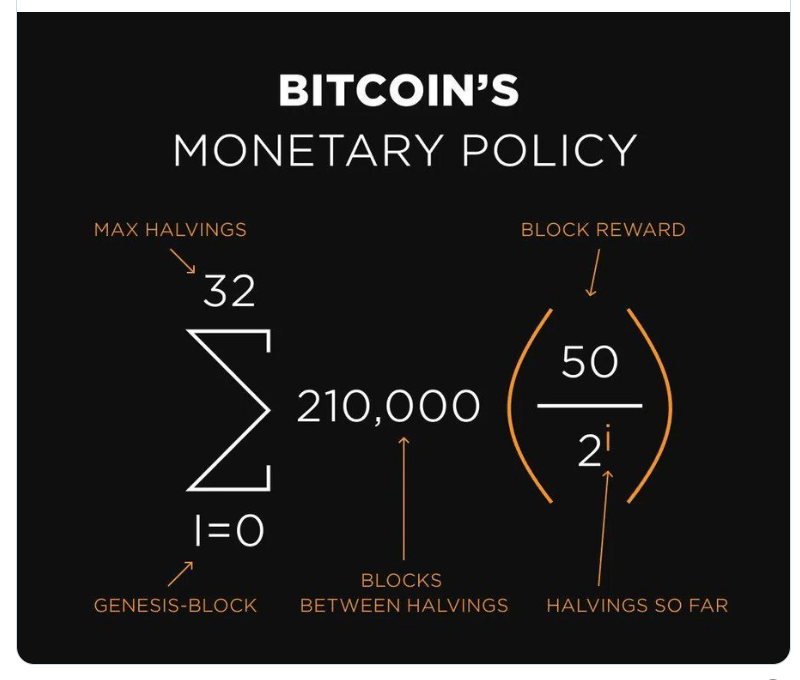

Halving Is Mostly Irrelevant

Halving does not reduce the supply of Bitcoin. That’s a cold hard fact that people struggle with.

The supply of Bitcoin is every Bitcoin ever mined minus lost keys. Halving changes the rate of increase of the supply of Bitcoin.

Similarly, the supply of gold is every ounce ever produced minus coins lost at sea, buried and forgotten, used in commercial applications or tooth fillings and now in landfills.

I would hesitate to guess whether there are more lost keys than lost gold in percentage terms.

Regardless, we are now at the point where the rate of increase in supply of Bitcoin is less than the rate of increase in supply of gold.

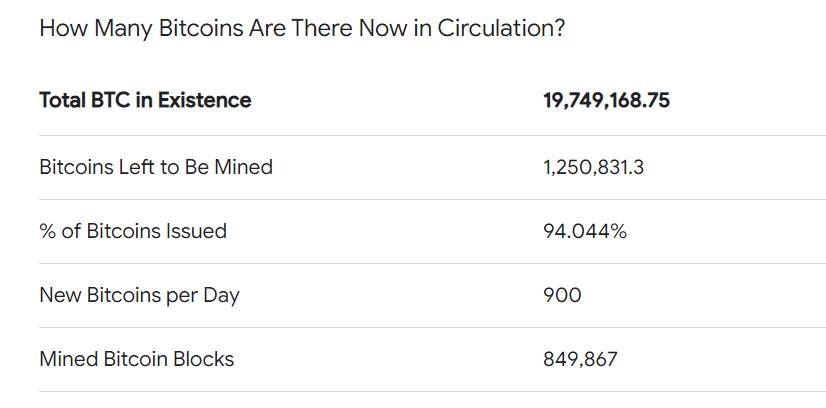

How Many Bitcoins in Circulation?

Assuming those numbers are reasonably accurate, ~94 percent of Bitcoins that ever will be mined have already been mined.

Further halvings will parse out the next 6 percent of supply over increasingly long periods of time.

For all practical purposes the current supply is the final supply. Thus, future halvings cannot realistically matter, mathematically speaking.

“Who else is waiting for 2028?”

How can it matter?

Oddly, one way that it can matter is if people believe it matters. The hype surrounding halvings is similar to hype about stock splits.

But that reaction only lasts for a short time. So now we have to look forward to hype that gets further and further into the future.

Perhaps the next hype being so far off is a net negative psychologically. I’ll buy in 2027 mentality.

Bitcoin Monetary Policy?!

Bitcoin has no monetary policy. It is not money and likely never will be for the simple fact that no major government will ever hand over monetary policy to an asset it does not control.

Governments can easily squash Bitcoin.

That’s another statement of fact Bitcoiners will reject. But if government banned the buying and selling of Bitcoin (or taxed the hell out of it), there would be no way to use that Bitcoin other than direct barter.

You can keep your Bitcoin, but it would be useless other than direct barter because no merchant would accept it. There would be no way to get fiat money into or out of Bitcoin. Period. If you disagree, please answer this question: How do you get money into Bitcoin if governments do not allow that or tax the hell out of it?

This is not realistically debatable. Nonetheless, I expect ridiculous attempts at rebuttal based on half-assed measures by China or whatever.

The real question is not whether governments could kill Bitcoin, but rather the likelihood of that.

I used to think this would happen. Now I don’t. But it all depends on whether Bitcoin ever gets high enough for governments to fear Bitcoin. The higher the price of Bitcoin, the more likely the government reaction.

The Transaction, Collateral, and HODL Triangle

For Bitcoin to gain widespread acceptance in transactions and as collateral, volatility and speculation are the enemy.

For speculation purposes and buy the dip HODLing, volatility is an asset not a detriment.

Meanwhile, it is increasingly obvious that Bitcoin is among the most, if not the most, speculative thing invented.