If we are not building enough units to handle population growth including illegal immigrants, we are going to have a serious rent inflation issue making the Fed miserable.

I created the above chart by subtracting housing completions from housing starts. 18 months ago completions began outpacing starts.

Negative 300,000 was the most negative since June of 2010 at the end of the Great Recession.

Bear in mind these are seasonally adjusted annualized rates (SAAR).

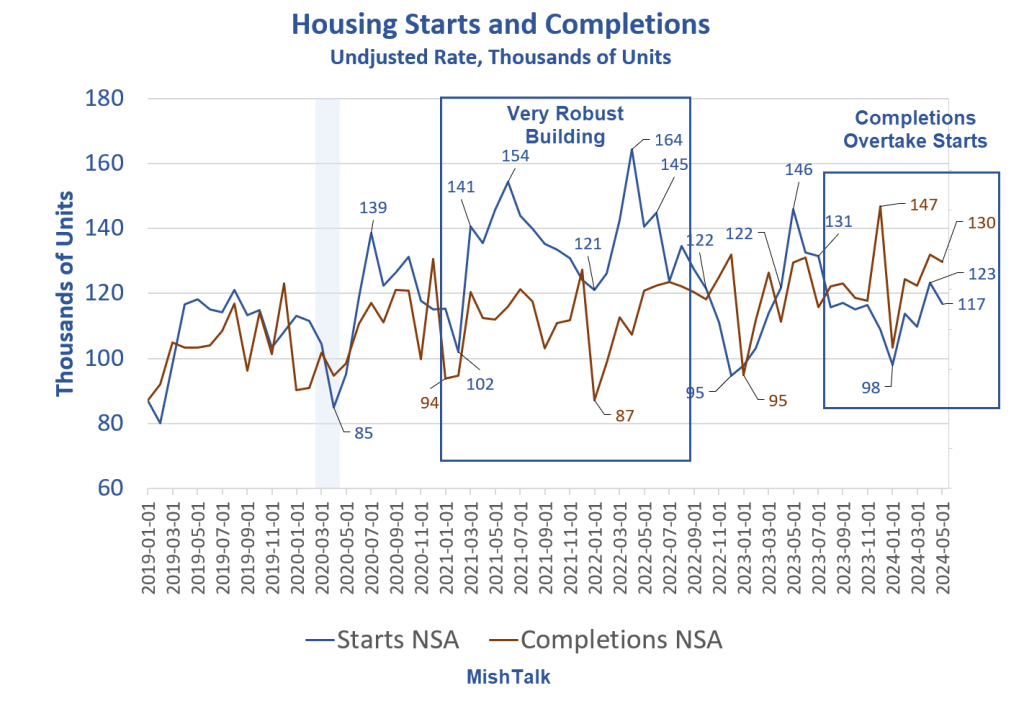

Unadjusted Housing Starts and Completions

The unadjusted number of starts in May of 2024 was 117,000. The Commerce Department reports that as 1,277,000 SAAR. Completions SAAR were 1,514,000 yielding a difference of -237,000 shown in the lead chart.

Housing Starts Minus Completions

On an unadjusted basis completions have outpaced starts for 10 consecutive months. Numbers range from 1,000 to 38,000.

Housing Units Under Construction

There is a massive number of housing units under construction, most of which are multi-family.

Single-family units under construction is in a range that on average looks normal. Multi-family is another matter.

Housing Starts Single-Family vs Multi-Family

The above chart shows we can expect completions to outpace starts especially multi-family.

Is the Pipeline Big Enough for Rents to Drop Substantially?

That’s the key question.

For three years now economists have been expecting the cost of rent to decline? However, for 33 consecutive months the BLS reports rent has gone up at least 0.4 percent per month.

The CPI is Flat for the Month, but Rent is Up Big Again

On June 12, I commented The CPI is Flat for the Month, but Rent is Up Big Again

Owners’ Equivalent Rent and Rent of Primary residence were each up another 0.4 percent in May.

That marks the 33rd consecutive increase of at least 0.4 percent for both.

I expected a flat CPI this month with rent and OER pulling back a bit. Had they fallen, we would have had a negative CPI.

At some point this year, I believe rent will abate. If not, the Fed is going to have one heck of a time bringing down the year-over-year CPI currently 3.3 percent.

My May 15 Rent Comments

The “rents are falling” (or soon will) projections have been based on the price of new leases and cherry picked markets. But existing leases, much more important, keep rising.

Only 8 to 9 percent of renters move each year. It’s been a huge mistake thinking new leases and finished construction would drive rent prices.

Most leases renew in May through August. I expect rent to moderate soon.

Unlike most other analysts and economists, it’s only in the last two months that I finally started to expect rent increases to abate.

Rent abatement appears to be happening in select cities like Austin that seem hugely overbuilt, but it has not shown up nationally yet.

Is the Rent Pipeline Big Enough Nationally?

The deflation, disinflation, Fed needs to cut rates now crowd has been incorrectly singing that tune for over two years.

However, the Wall Street Journal had an interesting post a few days ago. Please consider Rent Hikes Loom, Posing Threat to Inflation Fight

Apartment dwellers got a break recently when rent growth slowed and fell in parts of the country following years of steep increases. That relief appears to be ending.

Rents in several Northeast and Midwest cities, such as Kansas City, Mo., and Washington, D.C., are rising this year.

While asking rents for new leases nationally are running nearly flat over the past 12 months, those figures are heavily influenced by the Sunbelt, where record-high supply has turned rent growth negative in some cities, according to most property data and brokerage companies that track them.

The least affordable home-sales market in decades is compelling more renters to stay put. Large apartment owners say fewer renters are moving out to buy homes than ever before, put off by record home prices, limited inventory and higher mortgage rates.

“Rental demand is definitely rebounding,” said Igor Popov, chief economist at the listings website Apartment List. “We’re past the bottom.”

Strong job growth has also opened the door for landlords to raise rents. “That gives them pricing power,” said Linda Tsai, a real-estate equities analyst at Jefferies.

Rising rents complicate the inflation picture and could make it challenging for the Federal Reserve to ease interest rates. Labor Department data showed that inflation was cooler than expected last month, but the prospect of more apartment owners raising rents could offset lower prices in other areas.

Truflation Nonsense

The “rents are falling” consortium keeps pointing to Austin. But it’s much more complex than the sunbelt.

And for years I have been pointing out the fallacy of judging the rental market based on new leases.

Apartment List, Zillow, and Redfin all make this major mistake.

So does Truflation which ridiculously claims the year-over-year rate of inflation is 2.15 percent as of today.

I discussed Truflation and what’s wrong with it on April 20, in my post Truflation Claims Inflation is 2.06 Percent, Anyone Believe That?

Would you believe believe year-over year inflation is barely over two percent? That’s the Truflation claim as of April 17, 2024.

The idea that you can take inflation, exclude the price of houses, essentially ignore renters, use new leases rather than renewals and concoct inflation at 2.15 percent is ridiculous.

Truflation purports to be more timely. OK, it’s more timely nonsense, revised daily.

Why Angry Renters Will Decide the Election, Take II

Economists say wages are now rising faster than the CPI. That’s not true for those who rent or wish to buy a house.

Those Who Rent Are Angry

Roughly 36 percent of households rent. They watch home prices soar out of sight while wages do not keep up with rent.

Yet economists tell these renters they should be happy because wages are now rising faster than the CPI. Sorry guys, wages are not rising faster than the average renter’s personal CPI.

And housing prices are not even in the CPI.

For discussion, please see Why Angry Renters Will Decide the Election, Take II

The BLS weighs rent at 7.61 percent of the CPI.

Tell that to renters looking to buy a home. Those who rent are likely paying 20 to 40 percent of their salary towards rent, certainly not 7.61 percent.

At least 26 percent of the nation thinks the way we calculate the CPI is nuts. Truflation, supposedly an improvement, compounds the errors.

My lead question remains: Are We Building Enough Housing, In the Right Places? Too Much?

If rent and the price of houses are not enough to make a huge subset of the population unhappy, here’s an added bonus:

Job Openings vs Unemployment Looks Very Much Like a Recession Has Begun

The block of apartments under construction is enormous.

It better be enough to slow rent and deal with 8 million illegal migrants who need shelter, or the Fed is in serious trouble.