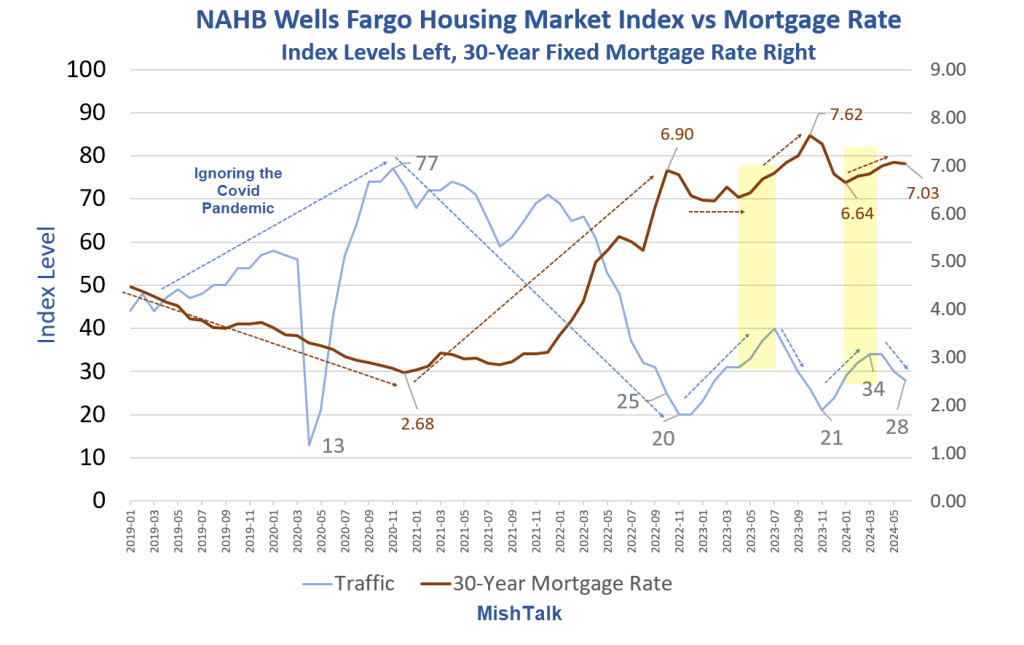

The National Association of Homebuilders HMI index struggles to gain any lasting positive momentum. Traffic from potential buyers is abysmal.

Understanding the Index

The NAHB/Wells Fargo Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market.

The NAHB/Wells Fargo HMI is a weighted average of three separate component indices: Present Single-Family Sales, Single-Family Sales for the Next Six Months, and Traffic of Prospective Buyers.

Each month, a panel of builders rates the first two on a scale of “good,” “fair” or “poor” and the last on a scale of “high to very high,” “average” or “low to very low”. An index is calculated for each series by applying the formula “(good – poor + 100)/2” or, for Traffic, “(high/very high – low/very low + 100)/2”.

Each resulting index is first seasonally adjusted, then weighted to produce the HMI.

HMI Index Weights

- Present Sales: 0.5920

- Sales for the Next Six Months: 0.1358

- Traffic: 0.2722

- The weights were chosen to maximize the correlation with housing starts through the following six months.

Six Month Expectations

What homebuilders expect 6 months out is extremely correlated to present conditions making it all but useless.

I removed the outlook from the index and did a recalculation leaving the combined weight still add up to 100.

My calculation did not change the index much, dropping the index from 43 to 42, from 45 to 44, from 51 to 50, from 51 to 49, and from 48 to 46 in the last five months, most recent first. This is due to the small weight the NAHB assigns to homebuilder expectations.

NAHB Housing Market Index vs Mortgage Rate

Generally speaking, and as expected, traffic picks up as mortgage rates decline and slows when mortgage rates rise.

The yellow highlights are a couple of minor instances where the expectation did not hold true.

NAHB Wells Fargo Housing Market Index Since 1985

The long-term chart shows traffic readings under 30 are infrequent with readings under 20 very infrequent.

Except during the Great Recession, traffic readings under 20 have been contrary indicators. We are not there yet.

Housing Starts Rise 5.7 Percent Following Negative 2.6 Percent Revision

The latest New residential construction report was in May, for the month of April.

I reported Housing Starts Rise 5.7 Percent Following Negative 2.6 Percent Revision

The word of the day is revision. The Census Department revised housing starts and permits all the way back to 2017.

The NAHB says “The weights were chosen to maximize the correlation with housing starts through the following six months.”

Good luck with that given volatility, high margins of error, and revisions in the residential construction reports.

The NAHB has a link that discusses the correlation, but it’s broken. I notified the NAHB of that today.

I suspect the NAHB traffic measure in isolation is a better measure of what’s on consumers’ minds than attempts to subjectively measure three components trying to match a report that itself is questionable.

Existing-Home Sales Mostly Stagnant for 17 Months

On May 22, I reported Existing-Home Sales Decline 1.9 Percent, Sales Mostly Stagnant for 17 Months

Existing-home sales fell 1.9 percent in April and are also down 1.9 percent from a year ago. Sales have not gone anywhere for 17 months.

New Home Sales Sink 4.7 Percent on Top of Huge Negative Revisions

For discussion, please see New Home Sales Sink 4.7 Percent on Top of Huge Negative Revisions

New Home Sales plunged. And the Census Department completely revised away last month’s fictional 8.8 percent rise.

Housing Short Summation

Housing is broken and the Fed is largely to blame.

As noted in February, The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

I need to update that post, but nothing much has changed.

The HMI, starts, new home sales, and existing-home sales have been floundering for two years.