Housing starts have collapsed in percentage terms, but this will still be a record year for multi-family housing completions. What does it mean?

Will Multi-Family Construction End With a Whimper or a Bang?

ApartmentList economist Chris Salviati discusses the last wave of the Multi-Family Construction Boom and its Impacts.

Following a period of record-setting rent growth, the national median rent has since dipped slightly from its late 2022 peak. One of the key factors in this rapid cooldown has been a surge of new apartment construction adding supply to the market. 2023 saw the most new apartments completed since the 1980s and the number of multifamily units under construction peaked late last year at a record level. With nearly a million units still in the pipeline, this year is on track to bring even more new inventory than last.

Looking further ahead, though, the end of the current supply boom is already in sight. There has been a sharp pullback in the number of new multifamily projects getting underway, and that will translate to a slowdown in apartments hitting the market next year and beyond. This report breaks down the latest data on multifamily construction trends and explores what it can tell us about where the rental market is headed.

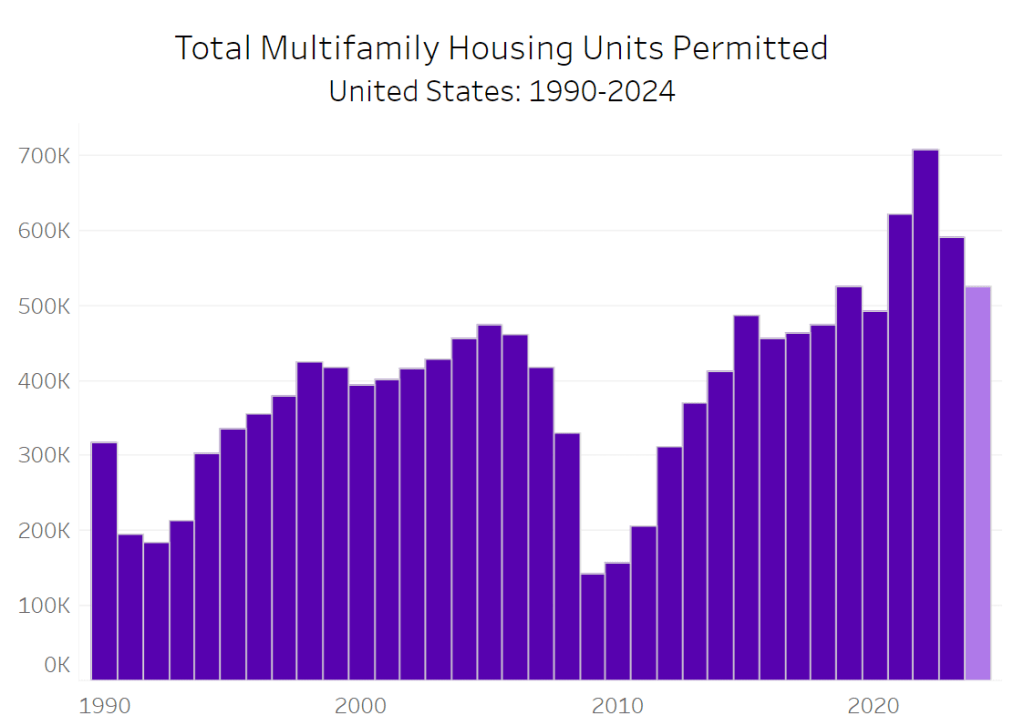

Total Multi-Family Housing Permits

On one hand, we’ve seen an abrupt slowdown in apartment construction activity. But on the other hand, when viewed over a longer horizon, current permitting levels remain fairly robust even after the decline. If 2024 does end with 525 thousand units permitted, as the year-to-date trend suggests, that level would be 26 percent below the 2022 peak, but it would still be 9 percent higher than the 2015 to 2019 average and higher than any year from 1987 to 2022.

Completions Still Rising

Despite the pullback in permitting, completions are still on the rise. It takes a long time for multifamily developments to get completed, and construction times have been getting even lengthier. In 2022, it took an average of 17 months for multifamily projects to go from construction start to construction completion (with an additional three month lag between permits being issued and construction getting underway).

Because of the lengthy construction time for multifamily projects, the slowdown in permitting activity has not yet translated to a slowdown in units hitting the market. Rather, the multifamily projects getting completed today are largely those that got started during the permitting boom of a couple of years ago.

Completed Units

Even though permitting activity has been slowing for some time, we’re only now hitting the peak of new supply hitting the market. The number of multifamily units under construction peaked in late 2023 at over a million, an all-time record. More recently, the number of units under construction has been gradually declining as the number of completions has begun to outpace the number of new units being issued. But even after the recent decline, the number of units still in the pipeline (919K) remains higher than at any point in history before the recent peak.

Austin Leads the US

Austin, TX serves as the prime example of the construction boom – the metro has led the way for multifamily permitting per-capita for seven years running. In 2023, 9.2 new multifamily units were permitted in the Austin metro for every 1,000 residents. For comparison, Austin’s pace of multifamily permitting last year was 61 percent higher than that of the second-ranked metro (Raleigh, NC) and 31 times greater than that of the metro with the slowest pace (Birmingham, AL). Austin is currently on pace to see a dramatic pullback in permitting in 2024 – but even with that pullback, Austin is still on pace to log the most new permits-per-capita this year.

Austin’s rental market is also illustrative of the impact that increased supply can have on prices. We estimate that rents in the Austin metro have dipped by 7 percent year-over-year, the sharpest decline of any large metro. This dip in rent prices is taking place even as the metro continues to experience strong demand, as the rapid pace of new construction has more than kept pace with the influx of new renters to the area.

Note that ApartmentList price comparisons are for new leases as opposed to renewed existing leases.

This issue has led to many bad assumptions and reports for at least two years that “rents are falling” when they haven’t been.

However, I do believe that after 32 consecutive months of rents rising national at least 0.4 percent per month, some good news is finally on the horizon.

Looking Ahead

The influx of new apartment inventory this year should result in a continuation of the market conditions that defined 2023, when increasing levels of new supply collided with softening demand, leading to a rapid slowdown in rent growth and increasing vacancy rates. Looking ahead to the remainder of this year and into next, we expect that these conditions are likely to persist. Unless demand rebounds to levels solidly above the long-term average, it’s likely that rent growth will remain soft and that vacancy rates could continue to inch higher. These trends will be especially pronounced in the southern markets that are seeing the fastest housing stock expansion.

Rising at 0.4 percent per month, for 32 month, rent growth is not exactly soft. But it is much softer than before, down from increases sometimes near 1.0 percent.

Looking Further Ahead

These conditions will not be indefinite, however. The pullback in new projects getting underway will eventually translate to a slowdown in new completions. We expect that 2024 will be the peak for new apartments hitting the market, and that next year will see fewer completions. When this happens, demand could begin to outstrip supply again, leading to tighter market conditions. The prevailing conditions in the rental market are currently bringing some much-needed relief to renters, but over the medium term, those winds are expected to shift.

Thanks Chris!

Missing Discussion Points

Missing from above discussion are many points regarding demographics, immigration, and interest rates.

First we have a huge ongoing wave of illegal immigration. This impacts current housing demand.

The second large factor is the eventual die-off of tens of millions of baby boomers. At what speed will that happen?

Third, I presume Trump will win but that’s not certain. Nor, despite all the bluster, can we say for sure how fast Trump can stop the immigration wave if he is elected.

Fourth, stopping the immigration wave is one thing, deportations are another. Where are deportations headed and how fast?

Fifth, what happens to interest rates?

What finally cooled construction is a big set of rate hikes by the Fed. Where are interest rates and mortgage rates headed?

Finally, what about recession?

Looking too far ahead is fraught with too many potential errors, but short term we can see a huge wave of completions on the horizon.

There are too many moving pieces, including a potential recession, that prohibit looking further ahead.

It will take a miracle for the Fed, the next president (regarding immigration), and the homebuilders to all get this right. Mistakes will be costly.