WASHINGTON — Satellite manufacturing startup Apex has raised $95 million to allow it to ramp up production of “productized” satellite buses to tap into growing demand, particularly from national security customers.

The Los Angeles-based company announced the Series B round June 12, led by XYZ Venture Capital, an early investor in Apex, and co-led by CRV, a new investor. Several existing and new investors, ranging from venture capital funds to individuals, also participated.

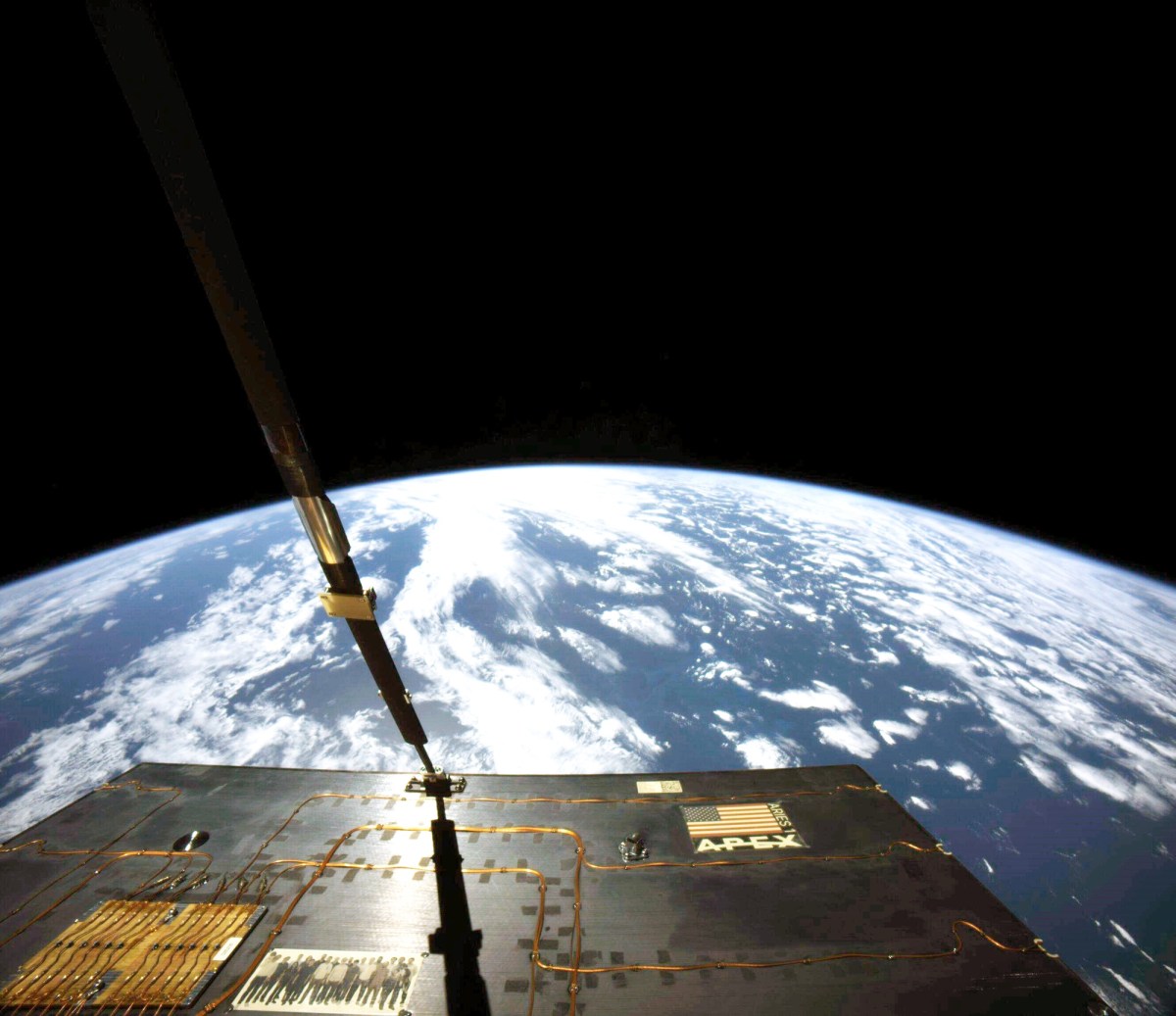

The company will use the funding to both accelerate production of its Aries satellite bus, which launched on an initial demonstration mission in March, and develop larger models called Nova and Comet. Aries is a 100-kilogram bus designed to accommodate up to 150 kilograms of payload, while Nova has double the capacity and Comet will support payloads up to 500 kilograms. All three buses are what Apex calls “productized,” able to be built in volume and configured by customers.

“We needed to increase the pace which we were ramping up production of Aries as well as moving forward the release date of Nova, so we decided to raise additional capital,” Ian Cinnamon, chief executive of Apex, said in an interview. “We’re very fortunate that we ended up raising far more money than we initially set out to.”

The funding will allow Apex to start producing Nova buses in 2025, with two expected to be completed and launched that year. That will tap into demand the company is seeing from U.S. government agencies, particularly in national security space. That demand grew after the March launch of the first Aries satellite.

“As we look at these proliferated LEO constellations, it seems to be a very good fit for some of the more complex payloads that required physically larger volume than Aries can support,” he said of Nova.

Cinnamon said the company had seen interest in its buses from companies planning commercial applications as well as government agencies and defense prime contractors, who wanted to use Apex as a bus supplier for their government contracts. Since the launch of the first Aries, “there has been an increase in the demand signal that we’re seeing from all three but especially from the defense primes.”

That growing customer interest attracted investors as well. “The funding round came together very, very quickly,” he said, taking about two months to complete.

“It was, relatively speaking, an easy choice to lead this round and catalyze a lot of capital that wanted to come into the company to go scale up,” said Ross Fubini, managing partner of XYZ Venture Capital, in an interview. He cited the progress the company had made on its vision of satellite manufacturing and the growing interest in its products.

He agreed that there was a strong opportunity for Apex among government customers. “I think there’s a great opportunity in public sector,” he said, citing the volume of potential business and the “excellence at scale” required to serve those customers. “If you can do that, then you can go into the broader commercial ecosystem.”

One obstacle for satellite bus companies is the push by some customers to vertically integrate and develop their satellites in-house, something that companies ranging from Planet and Spire to Amazon and SpaceX have been doing for their constellations. Fubini said he was not concerned about that limiting the potential growth of Apex.

“I think you’re enabling everybody bought a very small number of players. I think that’s the opportunity,” he said. “You don’t have to do every satellite, obviously, to be a big business but if you’re the dominant standard, you’re going to make a really healthy business.”

Cinnamon said that the company plans to double its workforce to about 100 employees by the end of the year, with the bulk of the new positions in engineering and productions. The company’s new “Factory 1” facility in Los Angeles can accommodate increased production of Aries and Nova buses, he said, up to about 100 per year.

He added that the company would also use some funding to shore up supply chains and bring production of some components in-house. “Our preference is always to be able to work with suppliers, but we have some of our suppliers being very transparent with us and saying that at a certain order volume, they’re just not able to produce it that volume,” he said, declining to identify specific components where his company is seeing stresses in the supply chain.

Besides XYZ Venture Capital and CRV, participants in the funding round include new investors Upfront, 8VC, Toyota Ventures, Point72 Ventures, Mirae Asset Capital, Outsiders Fund, GSBackers; existing investors Andreessen Horowitz, Shield Capital, J2 Ventures, Ravelin; and angels Baiju Bhatt, co-founder of Robinhood, and Avalon Capital Group, private investment company founded by Ted Waitt, co-founder of Gateway, Inc.