Bloomberg reported that China is selling a record amount of US debt while buying gold. Previous reports of debt selling were false. Let’s check in with Michael Pettis at China Financial Markets for another opinion.

China Sells Record Sum of US Debt

Bloomberg reports China Sells Record Sum of US Debt Amid Signs of Diversification

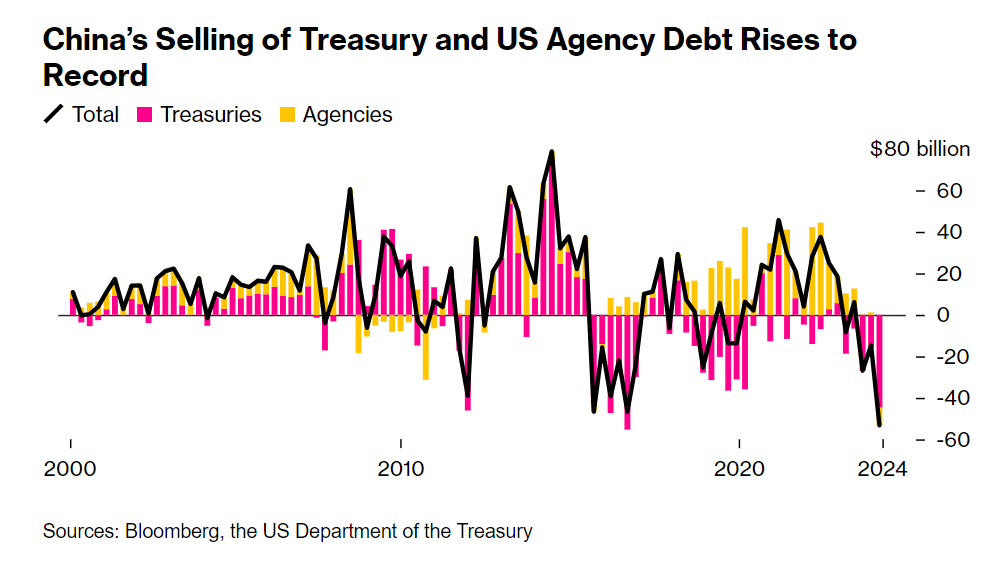

China sold a record amount of Treasury and US agency bonds in the first quarter, highlighting the Asian nation’s move to diversify away from American assets as trade tensions persist.

Beijing offloaded a total of $53.3 billion of Treasuries and agency bonds combined in the first quarter, according to calculations based on the latest data from the US Department of the Treasury. Belgium, often seen as a custodian of China’s holdings, disposed of $22 billion of Treasuries during the period.

China’s investments in the US are garnering renewed investor attention amid signs that tensions between the world’s largest economies may worsen. President Joe Biden has unveiled sweeping tariff hikes on a range of Chinese imports, while his predecessor Donald Trump said he might impose a levy of more than 60% on Chinese goods if elected.

“As China is selling both despite the fact that we are closer to a Fed rate-cut cycle, there should be a clear intention of diversifying away from US dollar holdings,” said Stephen Chiu, chief Asia foreign-exchange and rates strategist at Bloomberg Intelligence. “China’s selling of US securities could speed up as US-China trade war resumes” especially if Trump returns as president, he said.

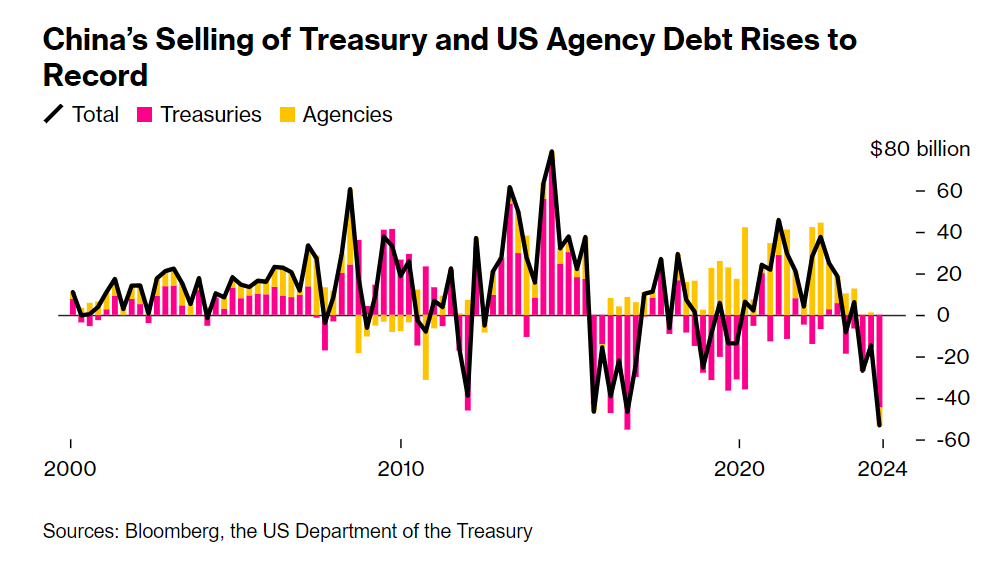

China is Buying Gold

One part of the story is not in question. That part pertains to China buying gold.

Is China Dumping US Debt?

I asked Michael Pettis that question yesterday. Pettis graciously replied with an email this morning plus a five-part Tweet.

Contrary to Popular Belief, Interest Rates Not Impacted

“If China were swapping US assets for assets of developing countries (which is unlikely), this would be a win-win-win, as it would likely lead to an increase in domestic investment in those countries.”

There is no doubt about that.

So, Who Pays the Price?

Data Muddied

By Email: “It’s possible, but the data are so muddied that it’s hard to tell. I hope its true.”

Since we have had this discussion before, by muddied, I believe he means China can mask it US debt holdings by parking them in State Owned Enterprises rather than official government holdings.

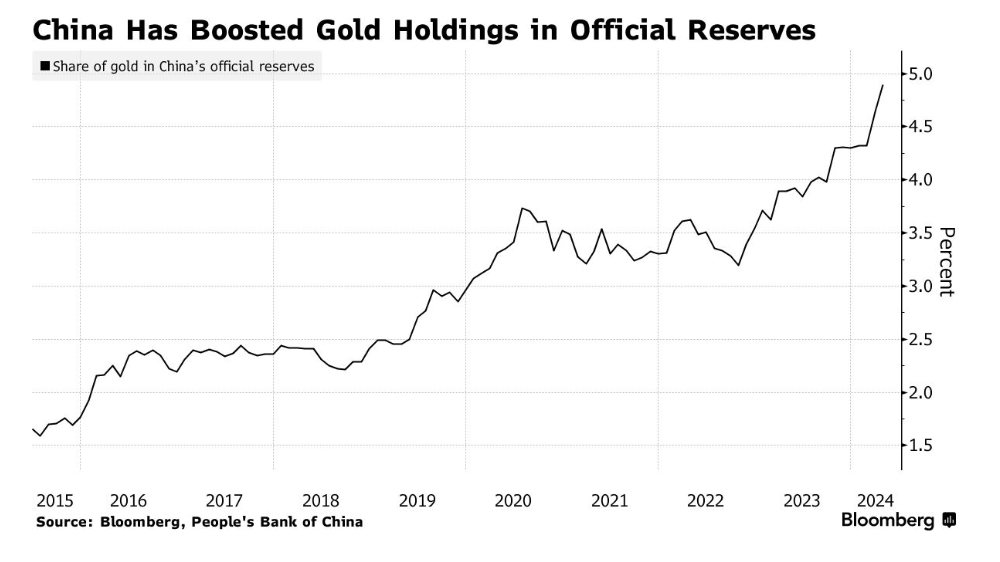

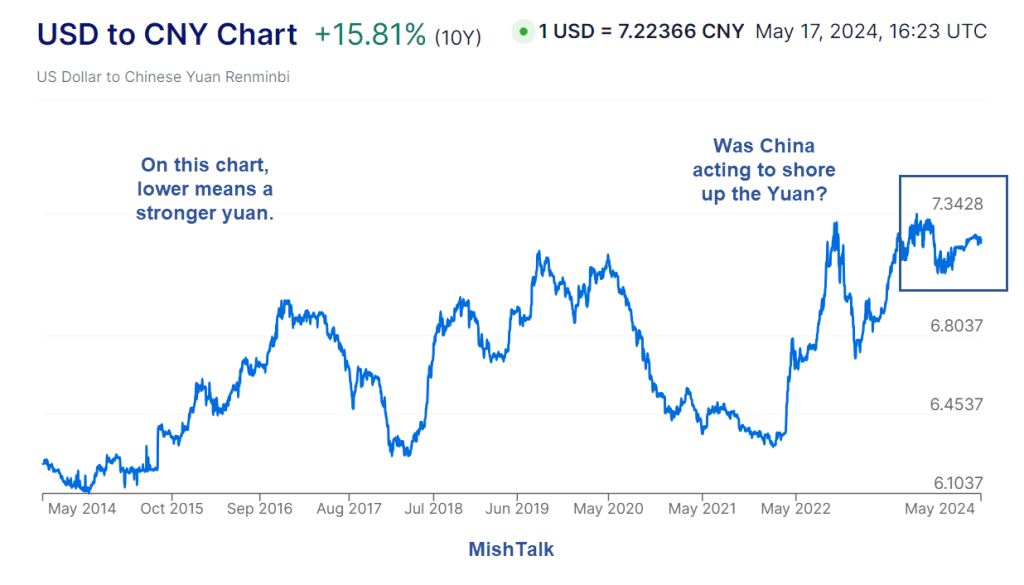

Another thing China has done in the past is to sell US treasuries as part of an effort to shore up the yuan. Selling dollars and buying yuan on the foreign exchange markets would tend to strengthen the yuan.

Is that going on?

I do not claim that is what’s going on now, but China has done this in the past. And if so, it’s not exactly a sign of strength, nor does the word “dumping” remotely apply.

Masking holdings in SOEs and efforts to shore up the yuan are two ways the lead chart might not be as it appears.

Contrary to the idea that “dumping treasuries is some sort of nuclear option by China that will wreck the US” it isn’t. Nonetheless, expect to see a lot of silly comments on that idea in many places.

It will be win-win-win if China assists other developing countries. Otherwise, China may be attempting to shift the pain away from the US to the EU, while buying gold as a hedge against sanctions.

China Shock II Is Coming, the EU Will Be Hit Hard, Then the US

This morning, before I saw the reply from Pettis, I commented China Shock II Is Coming, the EU Will Be Hit Hard, Then the US

Please click on the above link for discussion.

Also see BYD Unveils the “Shark” a Plug-in Hybrid Pickup Truck Built in Mexico

Made in Mexico is another way China tries to maintain export mercantilism. China and the US would both be better off if China did more to support Chinese consumption than exports.

Finally, please see Joe Biden vs Joe Biden on Tariffs, a Green Trade War Is Underway

I have been calling for an escalation of global trade wars for months. All the pieces are in place. In fact, escalation is clearly underway already. It will get worse no matter who wins the election.

So, returning to the lead question one more time, I give the nod to Michael Pettis: “It’s possible, but the data are so muddied that it’s hard to tell. I hope its true.”