Producer prices were a bit higher than expected today but negative revisions take that away. Importantly, prices appear to have bottomed.

The BLS reports the month-over-month PPI for April was 0.5 percent vs the Bloomberg Econoday consensus o 0.3 percent.

However, the BLS revised March from +0.2 to -0.1 so the year-over-year Econoday expectation was right on the mark at 2.2 percent.

PPI Details

- The Producer Price Index for final demand rose 0.5 percent in April.

- Final demand prices declined 0.1 percent in March and advanced 0.6 percent in February.

- On an unadjusted basis, the index for final demand moved up 2.2 percent for the 12 months ended in April, the largest increase since rising 2.3 percent for the 12 months ended April 2023.

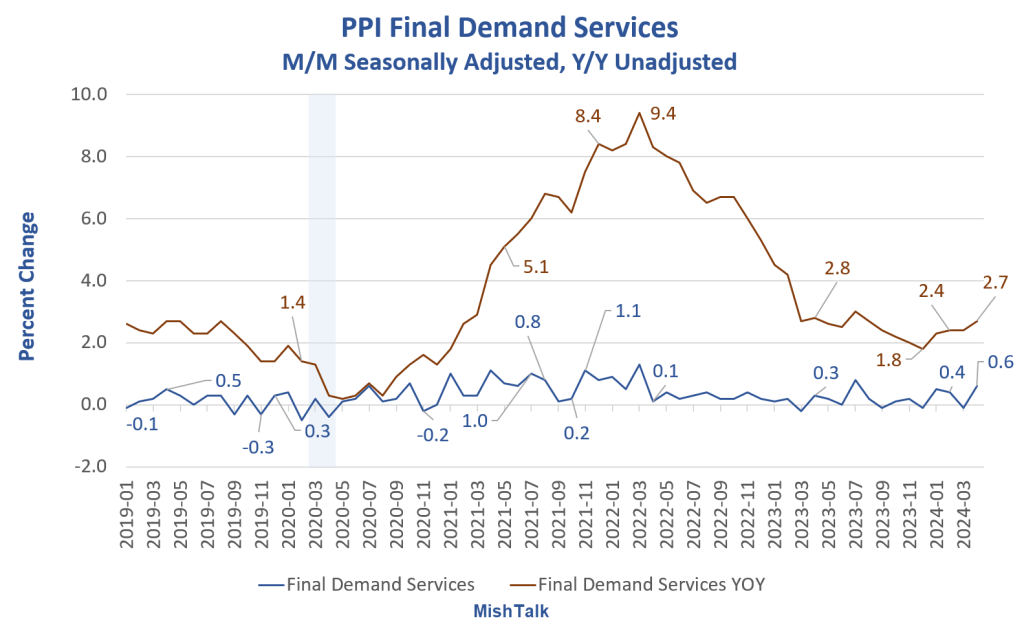

- Nearly three-quarters of the April advance in final demand prices is attributable to a 0.6-percent increase in the index for final demand services.

- Prices for final demand goods moved up 0.4 percent. The index for final demand less foods, energy, and trade services moved up 0.4 percent in April after rising 0.2 percent in March.

- For the 12 months ended in April, prices for final demand less foods, energy, and trade services increased 3.1 percent, the largest advance since climbing 3.4 percent for the 12 months ended April 2023.

Spotlight Services

Services have a bigger weight in the overall PPI than goods and they are rising steeper. Goods are influenced heavily by food and energy, both quite volatile.

PPI Final Demand Year-Over-Year Four Ways

PPI Year-Over-Year Details

- Final Demand: 2.2%

- Final Demand Goods: 1.3%

- Final Demand Services: 2.7%

- Final Demand Food: 0.5%

- Final Demand Less Food and Energy: 2.4%

For now, food is holding down the PPI. How much longer that remains is unknowable. But the key takeaway is the strength in services. If that filters through to the CPI, the Fed will have some difficulty unless rents turn lower.

I discussed rent twice recently. Please see Rent Prices Rose for the Third Straight Month According to Apartment List

Also see Quotes of the Day on Rent Inflation By the Fed and Property Managers

The Apartment List assessment is incorrect, as discussed. The BLS has rents up 0.4 percent for 31 consecutive months.

We find out the April CPI tomorrow.