Key Points

- The Reserve Bank of Australia voted to keep interest rates unchanged.

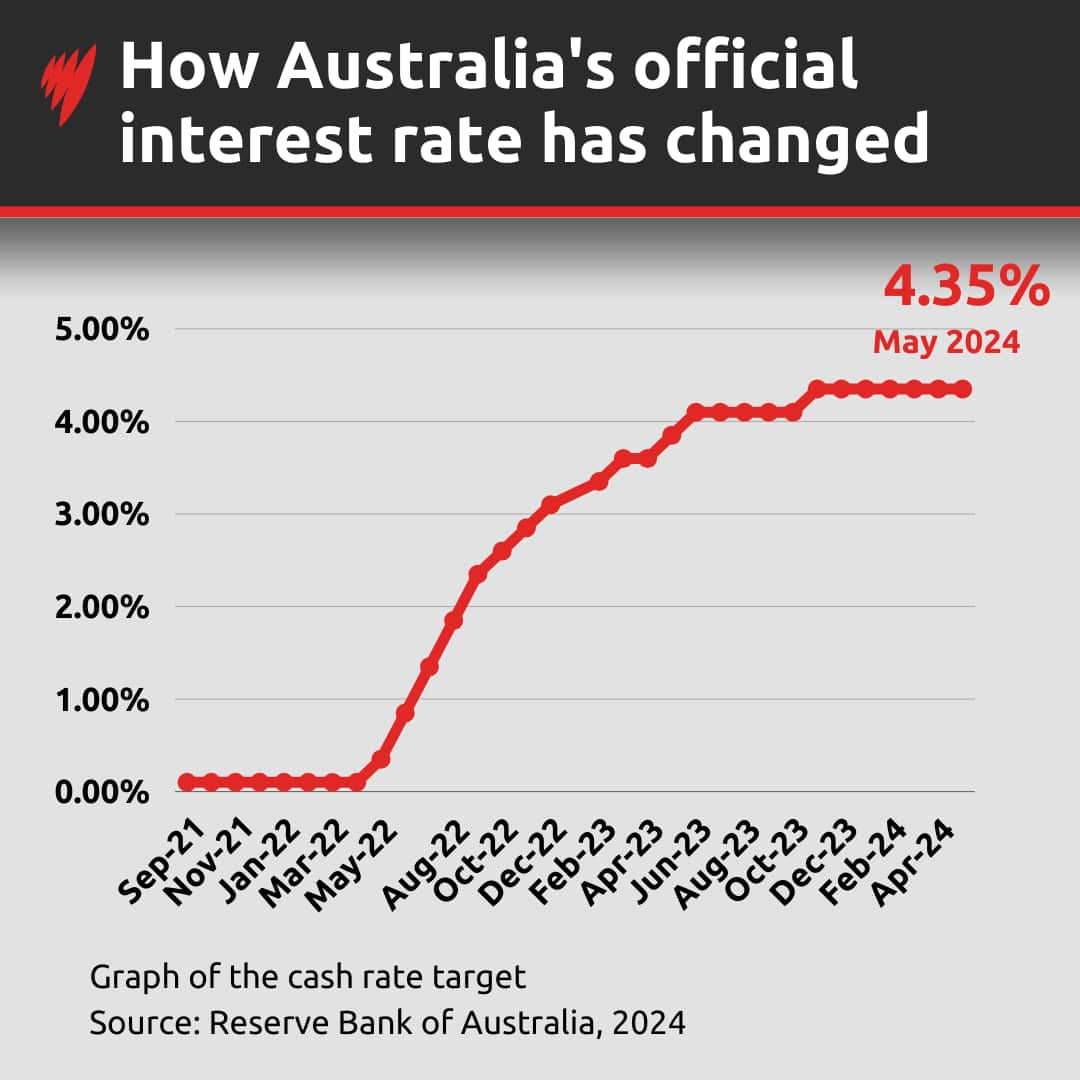

- Rates have been held at 4.35 per cent since November.

- The federal government has been cautioned against unintentionally driving up inflation in next week’s budget.

The Reserve Bank of Australia (RBA) board has voted to keep interest rates on hold at 4.35 per cent again in its final update before next week’s federal budget.

The bank did not rule out further increases and said the “process of returning inflation to target is unlikely to be smooth”.

While the RBA still expects to have inflation back within its target range of 2-3 per cent by December 2025, in the near term, price pressures are proving harder to budge.

It indicated high petrol prices and a tight jobs market could further increase inflation.

“Recent information indicates that inflation continues to moderate, but is declining more slowly than expected,” the bank said in its statement on Tuesday following the board meeting.

“Underlying inflation was higher than headline inflation and declined by less. This was due in large part to services inflation, which remains high and is moderating only gradually.”

RBA governor Michele Bullock said the bank is conscious of Australians “struggling to make ends meet” and noted household consumption is very weak.

“These people don’t have a lot of extra savings,” she told reporters.

“They might be working a second job, cutting back on discretionary items or making difficult decisions, such as putting off medical appointments. These people are doing it very tough, and the board and I are very conscious of that.”

When could interest rates come down?

Heading into the two-day meeting, analysts broadly agreed the central bank would be leaving interest rates at 4.35 per cent — where they have been since November.

IG market analyst Tony Sycamore said the probability of a rate rise of 0.25 per cent by August has fallen to around 25 per cent.

He said much hoped-for rate cuts could come in November, but “given the RBA’s heightened sensitivity to the incoming data the market will seek further insights into the economy’s trajectory and inflation from key data ahead of the next RBA meeting on June 18th”.

This includes waiting for Consumer Price Index figures and the federal budget.

“While we view the bar to another RBA rate hike as very high, we acknowledge the window for rate cuts in 2024 has narrowed and have pushed back our call for a first RBA rate cut from August until November.”

The four major banks (Commonwealth Bank, Westpac, ANZ and NAB) have predicted that rate rises have peaked and all bar ANZ have predicted they will lower to 3.10 per cent by November 2025.

Economists and Opposition politicians have cautioned that a big spending budget could increase inflation, which is taking longer than expected to come down and is one of the reasons interest rates have not been lowered.

KPMG chief economist Brendan Rynne said a budget in “expansion mode” would be the biggest threat to inflation taking off again.

He said government spending as a total of GDP was too high, running at around 27 per cent compared to the pre-pandemic average of around 24 per cent.

The ‘big four’ banks have all predicted that rate rises have peaked. Source: AAP / Joel Carrett

“What we really need now is for the federal budget not to add to aggregate demand – it should be neutral, or if possible, even slightly contractionary,” he said.

Opposition Treasury spokesperson Angus Taylor said the government needed to “contain its addiction to spending” or risk inflation staying higher for longer.

Yet Treasurer Jim Chalmers said both “scorched earth austerity” and “free-for-all-spending” needed to be avoided, noting that the economy was also dealing with slowing growth as well as persistent inflation.

Steve Mickenbecker, Canstar’s finance expert, said if borrowers opt to wait for the Reserve Bank to cut the cash rate and lenders to follow suit, they could be facing thousands of dollars in additional repayments and interest.

“Seizing the opportunity to switch now could result in considerable savings, especially with the first forecasted rate cut in November.

“By refinancing now, borrowers can lock away savings over the next six months or so if the cash rate cut comes in line with expectations of the big four banks in November, and then double dip when rates eventually fall. It’s hard to flaw this approach.”

Commenting on the outlook for rate relief, Mickenbecker said: “Uncertainties still loom with stronger than expected inflation, impending tax cuts and undisclosed cost of living relief in the federal budget that could potentially prolong the wait for rate relief into next year.”